This post guides you through every part of the Amazon FBA calculator. By the end, you’ll know how to use it like a pro, helping you handle your Amazon store’s ins and outs.

Stick with us as we explain how this calculator works, giving you the power to make intelligent choices and improve your profitability on Amazon.

What is the Amazon FBA Calculator?

The Amazon FBA Calculator is like your helper in figuring out how much money you can make when selling on Amazon. It’s a valuable tool that does the maths for you, showing how much you can keep after all the fees and costs.Making the most of your sales means understanding Amazon fees and profits. That’s where the Amazon FBA Calculator becomes your best assistant.

Here’s why it’s handy:

Smart Decisions: It helps you make smart choices. If you’re looking at different items to sell, the FBA Calculator can tell you which one might ultimately give you more money.

Avoid Surprises: It stops you from getting surprised by costs. You don’t want to find out later that you must pay any fees. The calculator shows you everything upfront.

Calculate Everything: You can figure out how much money you might spend, the fees Amazon charges, and how much profit you could make.

Know Your Costs: It tells you about the money you need to spend at the beginning and what you might spend each month.

When to Use the FBA Revenue Calculator?

It would help if you used the FBA Calculator when you want to figure out how much money you can make by selling items on Amazon. It’s excellent in a few situations:

Testing New Products

If you’re planning to sell a new product on Amazon, the FBA Calculator helps you decide if it’s a smart move. For example, if you want to sell a $25 backpack, you can input the selling price, shipping costs, and product costs. The calculator will show you how much profit you’ll make after Amazon’s fees.

Adjusting Prices or Costs

Thinking about raising your product price or negotiating with suppliers to reduce costs? Use the calculator to see the impact. For instance, increasing the price of your product by $5 might result in higher profits—or scare off buyers. The calculator helps you find the sweet spot.

Choosing Between FBA and FBM

Deciding whether to ship items yourself (FBM) or let Amazon handle it (FBA)? The FBA Calculator helps you compare costs. For example, shipping a product yourself might cost $8 per item, but Amazon’s FBA fees could be $5. The calculator will show you how much you save—or spend—on each option.

Maximizing Profits

If you’re looking to make the most money, the calculator helps you analyze all costs and pick the best strategy. For instance, if a product is too expensive to ship via FBA, you can tweak your approach or switch to FBM to cut costs and boost profits.

Which Fees Are Included in Amazon FBA Calculator?

1. Referral Fees

Referral fees are Amazon’s commission for using its platform and are charged as a percentage of the product’s selling price. The percentage varies by category, typically around 15%, but it can range from 6% for personal computers to 45% for Amazon Device Accessories.

For example, selling a $50 kitchen appliance incurs a $7.50 referral fee (15%). These fees apply to every sale and directly impact profitability, so understanding the rates in your category is critical. By factoring in referral fees during pricing, sellers can ensure they maintain reasonable profit margins while staying competitive in their product category.

2. FBA Fulfillment Fees

FBA fulfillment fees cover Amazon’s services, including storage, picking, packing, shipping, customer service, and returns processing. These fees depend on the product’s size and weight, with additional costs for items like lithium batteries or oversized goods.

For instance, shipping a small, 1-pound item might cost $3.22, while a large, 30-pound item might incur a $46.50 fee. FBA fees simplify logistics but can add up for larger products. Analyzing these fees helps sellers decide whether FBA is more cost-effective than self-fulfillment (FBM). Lightweight, fast-moving products typically perform better under FBA’s fee structure, ensuring greater profitability.

3. FBA Inbound Placement Service Fees

Amazon’s inbound placement service allows sellers to ship inventory to designated fulfillment centers chosen by Amazon, optimizing storage and delivery. These optional fees depend on shipment size and weight.

For instance, sending 500 units of lightweight goods may incur an inbound placement fee of $0.30 per unit, totaling $150. This service helps reduce delivery times and ensures inventory availability in high-demand areas. However, these fees increase upfront costs and should be balanced against potential sales gains.

Sellers with large inventories can use this service strategically to manage logistics while maintaining efficient delivery times and improving customer satisfaction.

4. Monthly Storage Fees

Monthly storage fees apply to inventory stored in Amazon’s fulfillment centers and vary based on size, weight, and season. For standard-size products, fees range from $0.87 per cubic foot (January–September) to $2.40 during Q4.

For example, storing 100 small water bottles (0.5 cubic feet each) in October would cost $120. Oversize products have slightly lower rates. High storage fees in peak seasons make inventory management crucial. Overstocking during Q4 can erode profits, so sellers should monitor sales velocity and adjust stock levels accordingly to avoid paying excessive storage fees while ensuring they meet holiday demand.

5. Long-Term Storage Fees

Long-term storage fees are charged for items stored in fulfillment centers for over 365 days. These fees are $6.90 per cubic foot or $0.15 per unit, whichever is greater.

For example, storing 200 slow-moving units (1 cubic foot each) for more than a year incurs a $1,380 fee. Long-term fees aim to encourage sellers to manage inventory efficiently and avoid excessive stockpiling.

Products with slower sales velocity should be monitored closely, and sellers can use strategies like promotions or price adjustments to clear aged inventory. Proper stock rotation minimizes long-term storage fees and maximizes profitability.

6. Variable Closing Fees

Variable closing fees apply to specific product categories, such as media items (e.g., books, DVDs, or CDs). For most media items, the fee is $1.80 per unit, regardless of the selling price. For instance, selling 20 DVDs at $10 each results in $36 in variable closing fees. These flat-rate fees can significantly impact low-cost media products, reducing overall profit margins. Sellers must account for this fixed cost when pricing items to maintain profitability.

Understanding these fees ensures better pricing strategies for media products, enabling sellers to remain competitive while accounting for Amazon’s fixed closing costs in their financial planning.

Fees are Not Included in the Amazon FBA Revenue Calculator

It’s important to note that the Amazon Revenue Calculator might not consider all the fees you could encounter. Here are some fees that aren’t typically included:

1. Monthly Subscription Fees

Amazon charges a monthly subscription fee of $39.99 for Professional sellers. This fee is a fixed cost and applies regardless of the number of items sold. For Individual sellers, there is no monthly fee, but they pay a $0.99 per-item fee. The subscription fee is not included in the revenue calculator because it is unrelated to specific products.

Sellers should account for this cost when calculating overall profitability, particularly if sales volume is low. For instance, if you sell 20 items monthly, the $39.99 subscription fee adds a cost of $2 per item to your overall expenses.

2. Per-Item Fees

Per-item fees apply to sellers using Amazon’s Individual selling plan, which charges $0.99 for each product sold. Unlike fulfillment or referral fees, this fee is unrelated to the product’s category or size and is not calculated by the revenue calculator. For example, selling 50 items per month as an Individual seller incurs $49.50 in per-item fees.

If your sales volume is high, switching to the Professional plan may be more cost-effective, as it eliminates per-item fees. Sellers should assess their monthly sales to decide which plan aligns better with their profit margins and business goals.

3. Removal Order Fees

These fees apply when sellers request Amazon to remove unsold inventory from fulfillment centers. The cost is based on the size and weight of the items. For standard-size products, removal fees typically range from $0.32 to $1.44 per unit, while oversize items may cost up to $2.38 or more.

For example, removing 100 standard-size units at $0.50 per unit costs $50. These fees are not part of the revenue calculator because they are occasional and depend on specific inventory decisions. Sellers should monitor slow-moving stock to avoid excessive removal fees and use promotions or discounts to clear inventory.

4. Return Processing Fees

For certain categories like clothing, shoes, or watches, Amazon charges return processing fees when customers return products. The fee equals the FBA fulfillment fee for the product. For instance, if the fulfillment fee for a $50 jacket is $5.68, the return processing fee is also $5.68. These fees are not calculated by the revenue calculator because they depend on the frequency and nature of customer returns.

Sellers in high-return categories should track return rates and include these costs in their profit analysis to better understand their true profit margins and minimize losses due to returns.

5. Unplanned Service Fees

Unplanned service fees occur when inventory sent to Amazon’s fulfillment centers does not meet labeling or packaging requirements. These fees typically range from $0.30 to $2.20 per unit, depending on the service required. For example, if you send 200 units missing barcode labels and Amazon charges $0.50 per unit for labeling, the total unplanned service fee is $100.

Since these fees are preventable, they are not included in the revenue calculator. To avoid them, sellers should ensure compliance with Amazon’s packaging and labeling guidelines before shipping inventory, reducing unnecessary costs and maintaining efficient operations.

6. Refund Administration Fees

When a customer is refunded for a returned order, Amazon keeps a portion of the referral fee. This is known as a refund administration fee and is typically 20% of the referral fee or $5, whichever is less. For instance, if the referral fee for a $100 product is $15, Amazon keeps $3 as a refund administration fee. These fees are excluded from the revenue calculator because they are linked to refunds rather than sales. Sellers should monitor refund trends and work to minimize returns through clear product descriptions, quality control, and customer service.

7. Rental Book Service Fees

Rental book service fees are specific to sellers renting textbooks through Amazon’s program. These fees are charged per rental transaction and vary based on the book’s size and weight. For instance, renting a textbook with a $15 referral fee might incur additional rental service fees of $3. These are not included in the revenue calculator because they apply only to a niche market.

Sellers in this category should account for these fees separately when evaluating profitability and consider the seasonal nature of textbook rentals when planning inventory and pricing strategies.

8. High-Volume Listing Fees

Amazon charges high-volume listing fees for sellers with more than 2 million active SKUs. The fee is $0.005 per SKU over the 2 million threshold. For instance, if a seller has 2.1 million SKUs, the high-volume listing fee is 100,000 × $0.005 = $500 per month. These fees are excluded from the revenue calculator because they apply only to high-SKU sellers.

Businesses with extensive catalogs should optimize their listings to ensure only profitable SKUs remain active, thereby minimizing these fees and maintaining manageable operational costs while maximizing profitability.

9. Other Less Common Fees

Additional fees, such as hazardous materials handling fees or manual processing charges, may apply in specific situations. These are generally rare and vary by product type or seller error. For example, a seller shipping hazardous goods might incur extra fees for compliance with safety regulations.

These fees are not included in the revenue calculator because they depend on unique circumstances. Sellers should review Amazon’s fee structure for their specific products and take proactive measures to comply with Amazon’s guidelines to avoid unexpected charges that could impact their profitability.

These fees are not part of the revenue calculator because they depend on broader business decisions or specific actions like refunds, returns, or inventory errors.

How to Use the FBA Revenue Calculator

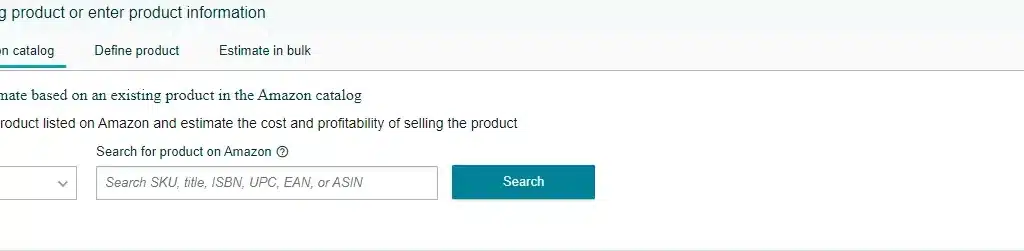

Step 1: Select Your Country

The first step is to choose your country. This ensures the calculator uses the correct fee structure and rates specific to your location. Amazon’s fees, such as referral fees and fulfillment costs, vary by region, so selecting the right country is essential for accurate results.

If you’re selling in the United States, the calculator will apply U.S.-based rates. If you’re selling in the UK or Canada, selecting the appropriate country ensures the fees reflect the local Amazon marketplace.

Step 2: Search for Your Product

Next, you need to find the product you’re analyzing. You can do this by entering the ASIN (Amazon Standard Identification Number), product name, or relevant keywords into the search bar. If you’re already logged into Amazon Seller Central, you can use the SKU (Stock Keeping Unit) linked to your product listing for even greater convenience.

Once you locate the product, the calculator automatically fills in essential details like dimensions and weight, which are crucial for estimating fulfillment costs.

Example:

If you’re selling a popular product like a stainless-steel water bottle, you could type “stainless-steel water bottle” into the search bar. Alternatively, you can enter the ASIN (e.g., B07XYZ123) for precise results.

Step 3: Input Pricing Details

After selecting your product, it’s time to input the selling price and any shipping charges. For Amazon FBA, shipping costs are already factored into the fulfillment fees, so you don’t need to include them separately. You can enter “0” for shipping if you’re using FBA. However, for FBM (Fulfilled by Merchant), you’ll need to include the shipping amount you plan to charge customers.

Be realistic with your selling price. Check what similar products are being sold for to ensure your pricing aligns with market trends.

Step 4: Add Fulfillment Costs

For both FBA and FBM, you’ll need to estimate the costs associated with storage, picking, packing, and shipping the product.

- For FBA, these costs are calculated automatically based on the product’s size and weight.

- For FBM, you’ll need to manually calculate expenses like packaging materials, warehouse fees, and shipping rates.

If your product weighs 1 lb and is small enough to fit in a standard shipping box, the FBA fulfillment fee might be around $3.22 per unit. For FBM, your shipping carrier might charge $4.50, plus $1 for packaging materials, making it slightly more expensive.

Step 5: Calculate and Analyze

Once all details are entered, click the “Calculate” button. The FBA calculator will provide an overview of costs and profits, including:

- Referral fees (a percentage of the selling price).

- Fulfillment fees (storage, picking, packing, and shipping).

- Net profit (after all Amazon fees).

You can compare FBA and FBM options to see which is more cost-effective. The tool allows you to adjust variables like the selling price or estimated shipping costs to test different scenarios.

Example:

If you’re selling the stainless-steel water bottle for $25:

- Referral fee: 15% ($3.75)

- FBA fulfillment fee: $3.22

- Total cost: $6.97

- Net profit: $18.03 (if COGS is $6)

Comparing FBA to FBM might reveal that FBA is cheaper for lightweight, high-volume products, while FBM might work better for heavy or low-demand items.

What is the Amazon FBA Fee Calculator API and How Can It Be Integrated?

The Amazon FBA Fee Calculator API helps sellers calculate FBA fees like referral fees, fulfillment fees, and storage costs programmatically. It’s a tool for developers to integrate fee calculations into apps or systems, allowing sellers to make informed pricing decisions.

Steps to Integrate the Amazon FBA Fee Calculator API

Sign up for Amazon MWS through your Seller Central account to get API access credentials, including your Access Key and Secret Key.

Review the provided API documentation to learn about its key functions, such as GetMyFeesEstimate, which calculates fees based on product details.

Collect necessary details like ASIN, selling price, product dimensions, and weight to ensure accurate fee estimates.

Use Amazon’s SDKs for languages like Python or Java to simplify integration. These pre-built libraries make it easier to connect with the API.

The API returns fee estimates, including FBA fulfillment, referral, and storage fees. Parse these responses to display them in your system or for analysis.

Embed the API into pricing or inventory tools to automate fee calculations and compare costs for FBA vs. FBM fulfillment methods.

Test the integration thoroughly and monitor its performance regularly to ensure accuracy and compatibility with Amazon updates.

Benefits of API Integration

- Automates fee calculations, saving time.

- Ensures accurate, real-time data for pricing decisions.

- Scales easily for large inventories

How to Calculate ROI with the Amazon FBA ROI Calculator?

The Amazon FBA ROI Calculator is a tool that helps sellers determine the profitability of their products by estimating their Return on Investment (ROI). ROI is calculated by comparing the net profit to the total costs involved in selling a product. Here’s how you can calculate it step by step:

Step 1: Enter Product Details

Start by inputting your product’s details into the ROI calculator. This includes the product’s selling price, cost of goods (how much you paid to source the product), and shipping costs to Amazon’s fulfillment center.

Step 2: Include FBA Fees

The calculator automatically estimates Amazon FBA fees, such as referral fees, fulfillment fees, and storage costs. If your product has additional fees, like for oversized items, ensure those are included for accuracy.

Step 3: Input Additional Costs

Add any other costs, such as advertising expenses, packaging, or inbound shipping costs. These are critical for calculating a true ROI as they directly affect your profit margins.

Step 4: Analyze Net Profit

The calculator will display your net profit by subtracting all costs (product, FBA fees, and additional expenses) from your selling price. For example, if your product sells for $50, costs $25 (including fees), and your expenses are $5, your net profit is $20.

Step 5: Calculate ROI

ROI is calculated using the formula:

ROI (%) = (Net Profit / Total Costs) × 100

For instance, if your net profit is $20 and your total costs are $30, the ROI would be:

ROI = ($20 ÷ $30) × 100 = 66.67%

Step 6: Adjust for Optimization

Use the results to adjust your selling price, reduce costs, or find better product sourcing options to improve your ROI. You can also compare multiple products to see which one offers the highest profitability.

Is the Amazon FBA Calculator Accurate?

The Amazon profitability calculator may not always be exact. The reason is that different sellers have different products and unique needs, making it challenging to create an accurate one-size-fits-all calculator.

It’s essential to see this Revenue Calculator as a helpful guide for evaluating FBA. However, Amazon doesn’t guarantee that the information or calculations in the calculator are always accurate.

To be sure, it’s good to independently check the results from this Revenue Calculator to make sure they match your specific situation and products. In simpler terms, while the calculator is helpful, it’s like a map – it can give you a direction, but you might want to double-check your route to be sure you’re on the right path.

Alternatives of Amazon FBA Calculator

Fortunately, you have options beyond relying solely on the Amazon FBA Calculator. Several alternative calculators cater to diverse needs and preferences, providing sellers with various tools to calculate their profits accurately. Here’s a closer look at five noteworthy FBA calculators that you might want to explore further:

Seller App: This calculator offers a comprehensive suite of features for Amazon sellers. It covers various aspects, including fees, profits, and other financial metrics, providing a holistic view of your business performance.

AMZScout: AMZScout is known for its user-friendly interface and robust set of tools. It helps sellers analyze potential products, estimate sales, and calculate fees, aiding in informed decision-making.

Jungle Scout: Widely used by Amazon sellers, Jungle Scout offers a suite of tools, including a profit calculator. It assists sellers in evaluating product ideas, estimating costs, and understanding potential profits in the Amazon marketplace.

Viral Launch: Viral Launch specializes in product research and market analysis. The FBA calculator they offer helps sellers assess profitability by factoring in various fees and costs associated with selling on Amazon.

Helium 10: Helium 10 is a comprehensive toolkit for Amazon sellers, including a powerful profit calculator. Beyond calculating profits and fees, Helium 10 offers additional features like keyword research and listing optimization.

These calculators offer different features and functionalities to help you choose the best fit for your needs. Exploring various tools to find the one that aligns most closely with your specific products and business model is always a good idea.

Maximize Your Amazon Profits with eMarspro

Our team of Amazon consultants uses advanced tools and software to manage your Amazon seller account effectively. Unlock strategic insights, streamline tasks, and double your profits with our proven expertise.

Ready to uplift your business? Contact us for a consultation and boost your sales on Amazon.